Many taxpayers have asked why their tax bills went up this year. School funding is complicated, and we want to help our community understand the details. Public schools are funded mainly through two sources: state aid and local property taxes. When state aid goes down, districts make up the difference through property taxes.

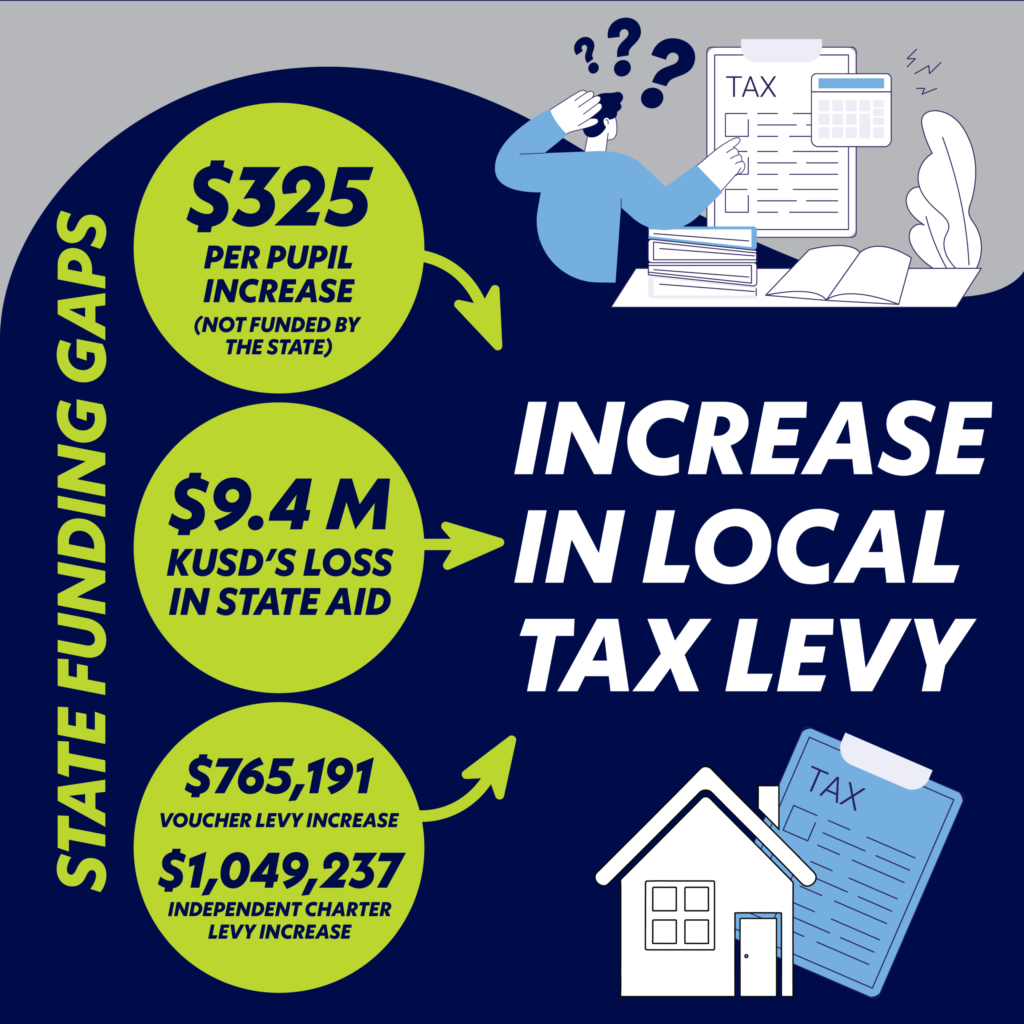

In the 2025-26 biennium budget, the Legislature approved a modest $325 per pupil increase, which lagged the inflation rate for the 17th consecutive year. However, they did not pair with increased state aid. This shifted costs to local property taxpayers, even though KUSD did not add new programs or expand services.

Here’s what happened this fiscal year:

- $325 per pupil increase not funded by the state.

- Additionally, KUSD received $9.4 million LESS in state aid because the state redistributed funds to other districts.

- Taxpayers also fund private school vouchers and independent charter schools. This year alone, the private school voucher levy increased $765,191, and the independent charter school levy increased $1,049,237. These funds are included in KUSD’s total on tax bills because the funds pass through public school budgets to voucher and charter schools.

- The local tax levy was increased to cover the state’s funding gap (e.g., less state aid, per pupil increase not funded by the state, and increased voucher and charter school levies).

- The tax increase was not caused by new or expanded local spending. It was driven by reduced state funding and shifts to local taxpayers.

When state aid falls short, local property taxes cover the gap. Bottom line: Less State Aid = Higher Local Taxes.

You can also click here for a detailed explanation of how to read your tax bill.