Written by Yessica Banda-Hernandez and Kaden West, Staff Writers

The Coronavirus pandemic has not only struck thousands of individuals physically, but is now affecting the world financially.

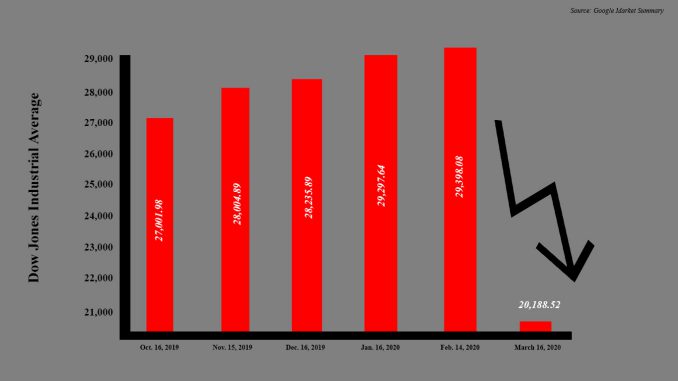

Just one month prior to now The Dow Jones was at an all-time high of 29,551.42. Due to the Coronavirus pandemic, the stock market has experienced a stunning crash which may lead America into another recession similar to the stock market crash of 2008.

“By one metric at least, the coronavirus-inspired mayhem on Wall Street now exceeds what was experienced during the 2008 financial crisis,” said CNN Business.

The Dow Jones has lowered drastically to 20,188.52, which shows the possibility for our market to head into a recession and for unemployment rates to climb yet again after staying at a steady, lower rate of about 3.5 percent at the beginning of this year.

Not only that, but stockholders started selling their stocks even after the 15-minute suspension causing the Dow to lose 12.9 percent, worst outbreak ever since 1987.

Goods from other countries are also being affected by the outbreak.

“Oil prices, which have been shaken by a price war between exporters, fell again. Brent crude dropped by more than 10% to less than $32 a barrel while West Texas International crude fell more than 8% to less than $30 a barrel,” states BBC News.

It is too early to make assumptions about the future of the market, but this outbreak has definitely shaken up American consumers.